Our ESG Framework guides us in running a responsible business

The built environment has a tremendous positive influence on the way we live, work and connect with each other. However, it also contributes to many of the challenges we are facing as a society, including climate change.

At Knight Frank, we want that influence to remain a force for good. As the largest privately-owned real estate advisory business in the world, we are using our global reach, independent voice and knowledge to help our sector become a responsible guardian of a healthy and sustainable future.

Our approach to ESG is driven by our purpose: to work responsibly in partnership to enhance people’s lives and environments. ESG is not just an integral part of the way we operate as a business but also how we work with our clients.

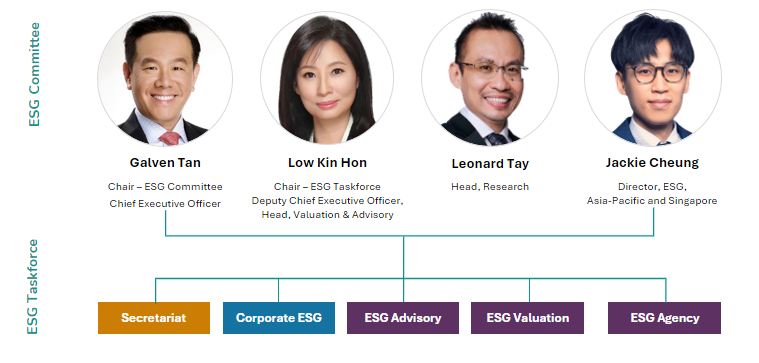

Our ESG Governance Structure

Governance is the foundation of implementing best ESG practices in any company. At Knight Frank, we have strong governance in place, and our collaborative and inclusive structure enables us to be transparent and accountable to our stakeholders.

Instead of solely having global governance structure, at Knight Frank Singapore, we are pleased to announce an important milestone in our ESG journey: a robust ESG governance structure for Knight Frank Singapore with board oversight.

Our ESG Committee, overseen by our executive board members and led by our CEO, Galven Tan, Deputy CEO, Kin Hon Low, and the ESG lead for Singapore and Asia Pacific, Jackie Cheung, steers over 20 Knight Frank advocates and specialists within the ESG Taskforce. They play a crucial role in integrating ESG principles across all our business operations. This governance structure is the foundation of our ESG strategy. It demonstrates our commitment to advancing our ESG journey in Singapore.

Stay tuned for updates on how the taskforce will collaborate to shape our corporate ESG priorities, evaluate the impact of our internal business activities, and integrate ESG considerations into the advice we provide to our clients.

Global net zero target validated by Science Based Targets Initiative (SBTi)

Knight Frank’s validated near-term and long-term targets by the Science Based Targets initiative (SBTi) Corporate Net Zero standard sit within an overarching commitment to reach net-zero greenhouse gas emissions, across our company’s value chain, by 2040.

In the near-term, we have committed to reduce absolute scope 1 and 2 GHG emissions by 42% by 2030 from the 2022 base year. This target covers our own operational energy use.

We have also committed to reducing scope 3 GHG emissions from use of client assets under property management by 51.6% per square foot and from investments under management by 51.6% per square meter within the same timeframe.

We have committed to reducing absolute scope 1 and 2 GHG emissions 90% and to reduce scope 3 GHG emissions from use of client assets under property management by 97% per square foot and to reducing scope 3 GHG emissions from investments under management by 97% per square meter under management by 2040.